We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

Debt rarely arrives with a trumpet. It slips in through ordinary doors: a neon loan sign on a tired strip mall, a hospital bill after a sudden scare, a just-today sales pitch that feels friendly until the paperwork lands. For many households, the trap is not one big mistake, but a chain of small compromises, each one bought with urgency and paid back with months of stress. The places below share a pattern: fast approval, fuzzy totals, and penalties that grow quietly.

Payday Loan Storefronts

The payday-loan storefront sells speed, not relief, often in the same strip mall as check cashing and pre-paid cards. A fee that looks like $15 per $100 can work out to an APR of almost 400% on a typical two-week loan, so the true price hides in the fine print. When the due date lands before the household budget can breathe, people patch the gap with renewals, bank overdrafts, and a second loan taken out to retire the first. The trap is the rhythm: short terms, constant urgency, and a balance that returns every 14 days, trimming the next paycheck and leaving less for everything else in the month, until the emergency, stops feeling short-term.

Source:

Buy-Here, Pay-Here Used Car Lots

At a buy-here, pay-here used-car lot, the pitch can sound like a rescue plan: no bank, no waiting, keys today, and a handshake that feels personal. The payment is made straight to the dealer, and the interest rate is often higher than a loan from a bank or credit union, so a shaky car can arrive with a heavy monthly bite, plus late fees that stack fast. When budgets slip, the vehicle is at risk, and in the title-loan world the CFPB has found that one-in-five single-payment borrowers have a car or truck seized for failing to repay, while more than four-in-five of these loans get renewed when due because the lump sum is unaffordable for months.

Source:

Rent-to-Own Showrooms

The rent-to-own showroom feels gentle: a couch, a TV, or a fridge delivered, with no credit check and a weekly price that sounds manageable, after one quick signature. The FTC has warned that the total cost of owning through rent-to-own is usually significantly higher than retail, and the slow drip of payments can disguise that markup for 12 to 24 months, especially when delivery and add-on fees get folded in. If a payment is missed, the item can be taken back, leaving the household without the product and without the money already paid, so the next replacement starts the meter all over again, and the home pays for the same comfort again too.

Source:

Timeshare Presentation Rooms

The free-breakfast timeshare presentation is built to make commitment feel like a vacation, with bright photos, countdown clocks, and a closer who never seems to blink. Contracts can run long, annual maintenance fees can rise, and the resale market can be unforgiving, which is why the FTC cautions against assuming a buyer will recoup what was paid. In that room, fatigue does real work: hours of small concessions, a rushed signature, and a promise that canceling will be simple, even though the path out can take years and the charges keep landing right on schedule. Long after the resort’s glow fades, the obligation still follows the owner home.

Source:

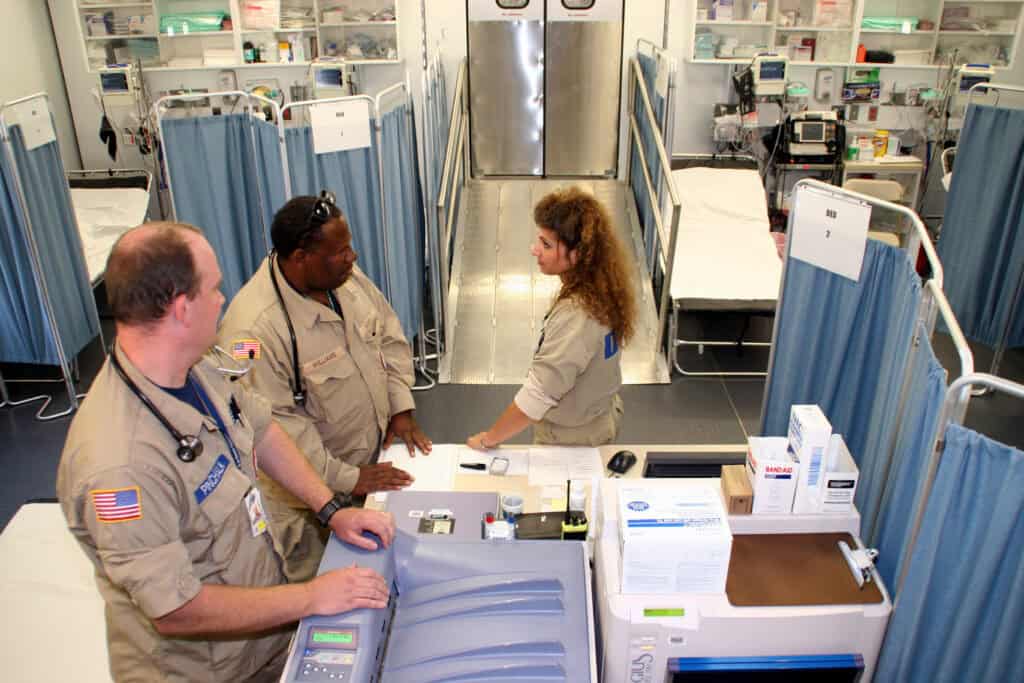

Hospital Emergency Rooms

The emergency room is a place of triage, not budgeting, and the debt often arrives weeks later, in envelopes, that do not match the calm of discharge. KFF reports that about four in ten adults carry some form of health care debt, and most people with that debt trace it to a one-time or short-term expense, like a single hospital visit or accident treatment. The stress deepens when charges splinter into separate bills from the hospital, physicians, and labs, then drift toward collections, where a household may pay on a card, borrow from family, or stretch a payment plan just to keep the lights on and the next illness starts on a weaker footing.

Source: