We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

Retirement in the United States looks very different depending on where you choose to settle. Some retirees prioritize warm weather and tax relief, while others care more about healthcare access, cultural life, or manageable daily costs. The places below stand out because they balance affordability, comfort, and long-term livability rather than short-lived trends. Each destination offers reliable infrastructure, strong medical systems, and an environment where retirees can stay active and socially connected. From coastal towns to mountain cities, these locations consistently rank well for people who want their retirement years to feel secure, engaging, and financially sustainable.

1. Sarasota, Florida

Sarasota has become one of Florida’s most complete retirement cities, combining coastal beauty with strong healthcare and cultural depth. The metro population sits near 470,000, large enough to support amenities without feeling overwhelming. Median home prices hover around $430,000, while average monthly living costs for retirees range from $2,300 to $2,600. Florida’s lack of state income tax helps fixed incomes stretch further. Sarasota Memorial Hospital is nationally ranked, and the city offers over 35 miles of beaches. Warm winters average 72°F, reducing heating costs and supporting year-round outdoor activity.

2. Asheville, North Carolina

Asheville appeals to retirees who want mild seasons and an active lifestyle surrounded by mountains. The city’s population is roughly 95,000, creating a close-knit feel with urban comforts. Median home prices average $410,000, and typical retiree living costs fall between $2,200 and $2,500 per month. Summers are cooler than most southern cities, averaging 83°F, while winters stay manageable. Asheville supports over 200 miles of hiking trails, a strong arts scene, and Mission Hospital, one of the region’s top medical centers, making long-term aging more practical.

3. Scottsdale, Arizona

Scottsdale is ideal for retirees seeking dry weather, golf access, and modern healthcare. With a population of about 245,000, it offers space without isolation. Median home prices are higher at roughly $680,000, but property taxes remain relatively low. Monthly retirement living costs average $2,600 to $2,900. Winter temperatures stay near 68°F, attracting snowbirds. Scottsdale ranks high for physician availability, with more than 350 doctors per 100,000 residents, and over 50 golf courses support an active, social retirement lifestyle.

4. Charleston, South Carolina

Charleston blends historic charm with modern retirement practicality. The metro area houses about 820,000 residents, providing extensive healthcare and services. Median home prices sit near $450,000, while monthly retiree expenses average $2,400 to $2,700. South Carolina offers tax breaks on Social Security and partial pension exclusions. The city’s walkable historic districts, coastal access, and cultural events support engagement. Average winter temperatures stay around 60°F, and major hospitals like MUSC provide advanced care for aging populations.

5. Madison, Wisconsin

Madison stands out for retirees who value healthcare and education-driven communities. With a population near 280,000, it feels lively yet manageable. Median home prices average $420,000, and monthly retirement costs typically range from $2,100 to $2,400. Winters are cold, but healthcare quality offsets climate concerns. UW Health and multiple specialty clinics rank highly nationwide. The city supports over 200 parks, extensive bike paths, and lifelong learning programs, making it especially appealing for intellectually active retirees.

6. Naples, Florida

Naples offers a quieter, upscale retirement experience focused on safety and wellness. The population is roughly 320,000 in the metro area, with a strong retiree demographic. Median home prices exceed $750,000, but crime rates remain about 40% below the national average. Monthly living costs average $2,800 to $3,100. Florida’s tax advantages still apply, and healthcare access is strong through NCH Healthcare System. Warm winters average 74°F, encouraging outdoor routines year-round.

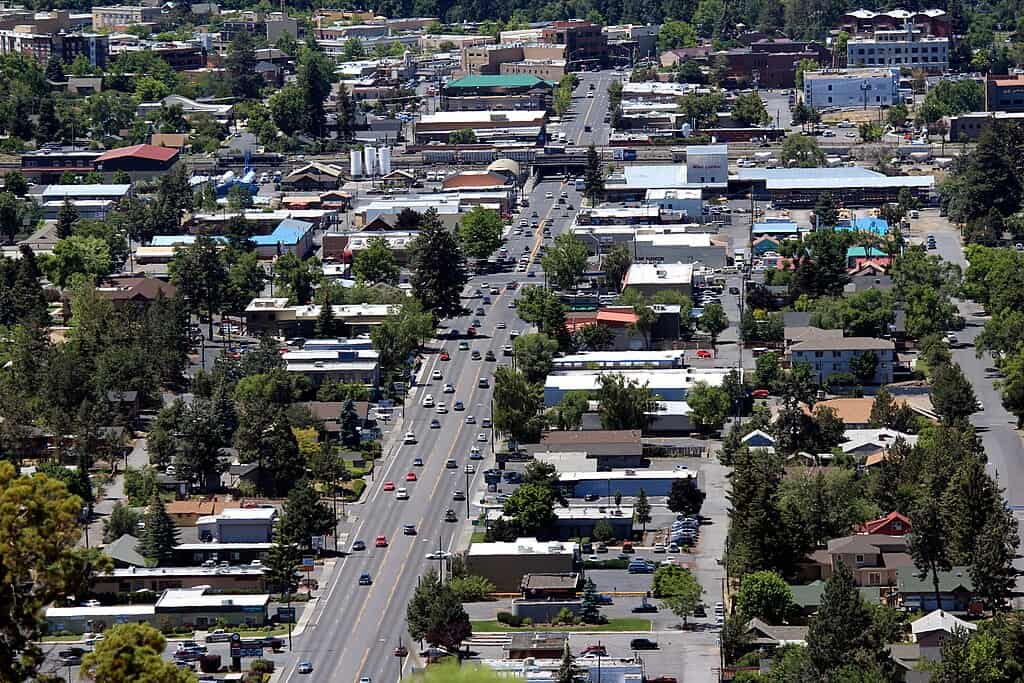

7. Boise, Idaho

Boise has emerged as a balanced retirement city for those avoiding coastal costs. The metro population is around 770,000, offering growing services without congestion. Median home prices sit near $475,000, and monthly retiree expenses average $2,200 to $2,500. Idaho taxes Social Security lightly, improving affordability. Boise scores high for clean air and safety, with crime rates below national averages. The city provides access to over 190 miles of trails and reliable healthcare through St. Luke’s Health System.

8. Savannah, Georgia

Savannah combines affordability with historic character and coastal proximity. The metro area population is about 400,000. Median home prices average $360,000, lower than many coastal peers. Monthly retirement costs range from $2,100 to $2,400. Georgia taxes Social Security minimally and offers retirement income deductions. Savannah’s flat layout supports walkability, while average winter temperatures stay near 62°F. Healthcare access continues improving with expanding hospital networks and regional specialty care.

9. Lancaster, Pennsylvania

Lancaster attracts retirees seeking stability and lower living costs. With a population near 530,000 in the county, it offers community without urban stress. Median home prices hover around $340,000, and average monthly retirement costs stay near $2,000 to $2,300. Pennsylvania does not tax Social Security or pensions. Lancaster General Hospital ranks highly statewide, and the area’s farmland setting supports slower living while remaining within 90 minutes of major cities.

10. Santa Fe, New Mexico

Santa Fe suits retirees drawn to culture, art, and high-desert living. The city has about 90,000 residents, keeping crowds minimal. Median home prices average $560,000, while monthly retirement costs range from $2,300 to $2,600. The dry climate averages 300 sunny days per year, benefiting joint health. Santa Fe offers strong Medicare access and specialized care. Cultural institutions, galleries, and festivals provide year-round mental and social engagement.

11. Knoxville, Tennessee

Knoxville offers affordability with access to nature and healthcare. The metro population is roughly 880,000. Median home prices sit near $330,000, and retirees typically spend $2,000 to $2,300 monthly. Tennessee has no state income tax, easing fixed-income planning. The city provides proximity to the Great Smoky Mountains, supporting active lifestyles. Healthcare systems like UT Medical Center deliver advanced services, while winters remain mild compared to northern states.

12. Bend, Oregon

Bend attracts retirees focused on outdoor recreation and clean living. With a population near 105,000, it maintains a small-city feel. Median home prices average $720,000, but quality of life scores remain high. Monthly retirement costs range from $2,500 to $2,800. Bend offers over 300 days of outdoor-friendly weather annually. Healthcare access continues expanding, and low humidity supports respiratory comfort, making it a long-term lifestyle choice rather than a trend-driven destination.