We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

When retirement finally arrived, it seemed like a green light to cash in on decades of daydreamed trips. Suitcases came out of storage, loyalty points were checked, and a generous travel budget felt like a well earned reward. Within a few seasons, though, that cushion started thinning faster than expected. Looking back, the damage did not come from one wild splurge, but from a handful of habits that quietly drained money while the memories were still being made. Those lessons came late, but they came with clarity.

Booking Every Trip At Peak Season

Retirement felt like permission to book trips at the most popular times, from school holidays to big city festivals that filled every plaza. Those dates came with inflated hotel rates, surge pricing on flights, and long lines that made simple days more expensive and less relaxing. By skipping shoulder seasons and quieter weeks with softer prices, the travel budget ended up funding crowds and markups instead of extra journeys that could have stretched across more years.

Chasing Luxury Hotels Instead Of Value

After years of work trips in basic rooms, the idea of luxury stays became hard to resist, almost like payback for missed vacations. High end hotels promised spa robes, rooftop bars, and flawless service, but the nightly rates quietly devoured savings that had taken decades to build. Many mid range options would have delivered comfort, good locations, and solid breakfasts without the price tag that turned every extra night into a serious financial decision.

Ignoring Currency Swings And Fees

It was easy to treat foreign prices as rough equivalents and tap a card without thinking about exchange rates or small service charges. Over time, gaps between the home currency and stronger ones, plus foreign transaction fees and poor conversion rates at airports, added up to hundreds of dollars lost. Booking long stays in countries where money stretched further, or using better cards and tools, could have preserved a surprising share of the travel fund for later adventures.

Overpacking Tours And Underplanning Rest

Retirement trips began to look like bucket list sprints, packed with guided tours, day trips, and prepaid experiences in every new city. Those bookings often overlapped or left no room for weather changes, fatigue, or new discoveries, so some paid outings went unused or felt rushed. A slower schedule with more unstructured days would have cut costs, reduced stress, and created more room for free moments that often end up as the strongest memories.

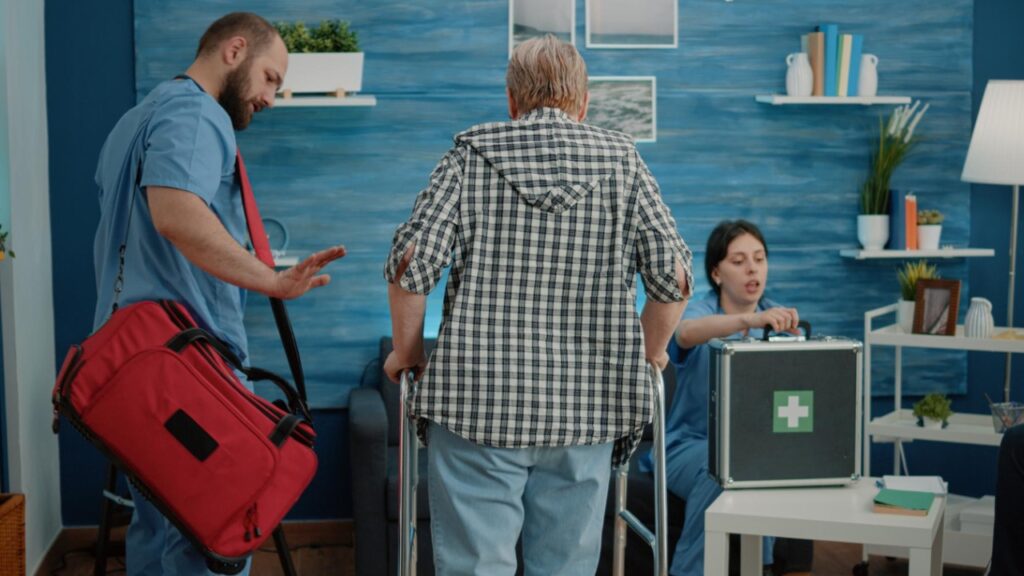

Forgetting That Health Costs Travel Money Too

It was tempting to think of health as a separate budget line, unrelated to flights and hotels. Skipping travel insurance on early trips, delaying routine checkups, and brushing off small aches led to urgent care visits in unfamiliar cities. Those bills, plus last minute itinerary changes, drained funds that could have covered future journeys. Treating wellness as a core part of the travel plan, not an afterthought, would have protected both body and savings.