We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

In some parts of the United States, home insurance has stopped being background noise and started feeling like a stress test. Wildfires, hurricanes, hail, and rising rebuild costs are pushing big brands to pause new policies or quietly walk away from entire regions. State Farm and Allstate are now shorthand for that shift in California and Florida, but interior states and small coastal towns are feeling the same squeeze. What connects these places is a hard new reality: even careful homeowners cannot assume their coverage will always be there.

California, State Farm And Allstate Redraw The Map

California has become the clearest warning sign. State Farm stopped taking new home applications in 2023, and Allstate had already paused most new homeowners and condo policies, pointing to wildfire losses, reinsurance costs, and soaring repair bills. Existing customers still have coverage on paper, but more nonrenewals, steep hikes, and inspections are nudging people toward the state FAIR Plan, which was meant as a last resort. A program built as a safety net is now carrying a heavy share of the market. For many households, the worry is simple: what happens if that last resort frays too.

Florida, Hurricane Losses And A Crowded Citizens Plan

Florida’s promise of sun and palm trees now comes with some of the harshest insurance math in the country. Years of hurricanes, roof lawsuits, and insurer failures have pushed several regional carriers out and led big national brands to trim their exposure. Citizens, the state-backed plan, has swollen with policies even as lawmakers try to push owners back into private coverage. Premiums can double in a few years, deductibles climb, and some families quietly gamble on going bare. The postcard still sells a dream, while the paperwork tells a different story and feels more fragile every season.

Louisiana, Storm Alley With Fewer Options

Louisiana sits in a storm corridor that has worn out both roofs and balance sheets. After back-to-back hurricanes like Laura, Delta, and Ida, multiple insurers collapsed, leaving policyholders suddenly stranded and shifting billions in claims to state guaranty funds. Larger companies responded with higher premiums, tighter underwriting, or quiet exits from vulnerable parishes that flood again and again. Many residents now rely on the state’s last-resort insurer, which was never designed to carry so much weight. Each new hurricane season lands on a market that already feels tired and thin around the edges, with less and less slack.

Texas, Hail Belts, Gulf Storms, And A Slow Squeeze

Texas tells its story through repetition rather than one giant disaster. Gulf hurricanes, inland hail corridors, and spring storms have produced long strings of costly claims that keep loss ratios stubbornly high. Many household names still write policies, but they lean harder on roof exclusions, larger deductibles, and strict inspections, especially for older homes with past damage. The FAIR Plan has quietly grown as owners who are turned away elsewhere look for any option that will satisfy a lender. It is not a dramatic exit, but a slow tightening that feels just as unnerving for people trying to stay put.

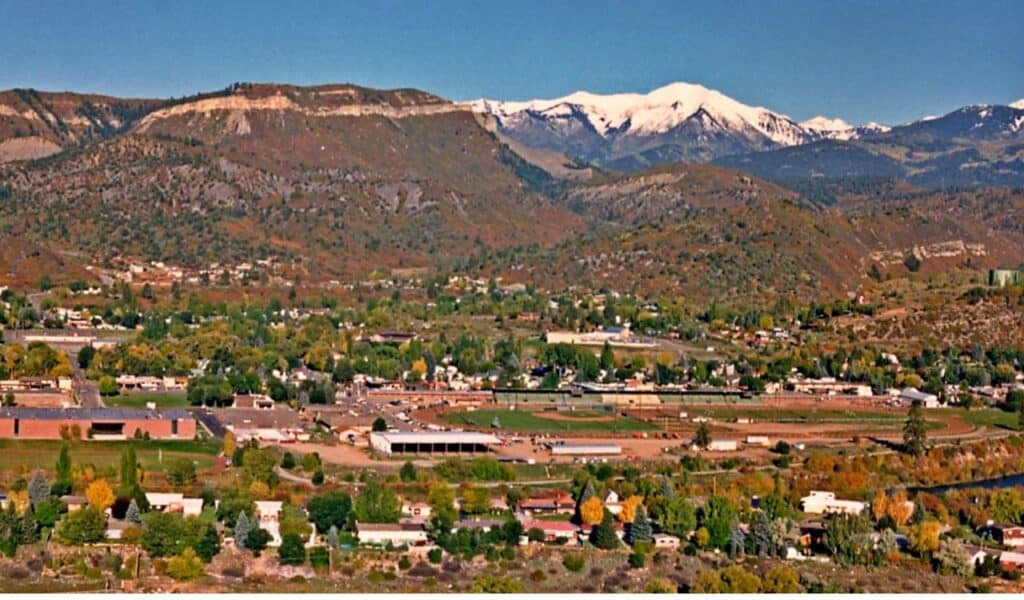

Colorado, Fire Country In The Front Range

Colorado’s Front Range once sold the idea of effortless mountain living, yet insurers now see a continuous band of wildfire risk. Premiums have jumped sharply in some foothill communities, and owners report nonrenewals that cite tree cover, narrow roads, or the lack of defensible space. New buyers sometimes discover that the house they love attracts only a few expensive quotes, if any at all. Local officials talk about shared fire-hardening projects and better evacuation planning, but those take years. Insurance, by contrast, can disappear with a single notice that arrives in the middle of a hot, windy summer.

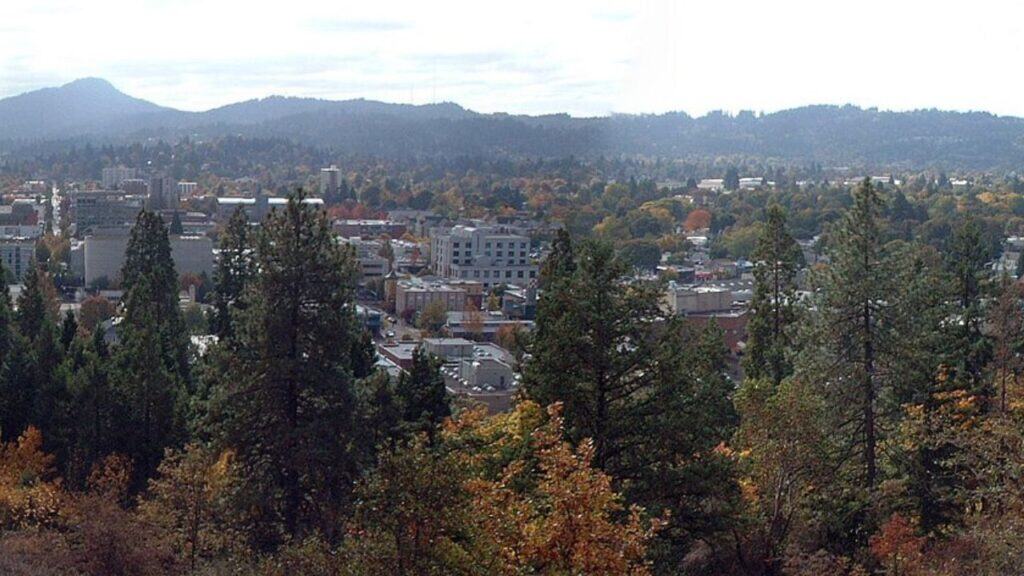

Oregon, Forest Towns On The Edge

In Oregon, forest towns tucked along canyons and ridgelines are learning how fast attitudes can change once a few big fires burn through. Properties that once felt like quiet escapes now sit in zones flagged for high fuel loads, steep slopes, and limited access for fire trucks. Insurers respond with inspections, surcharges, or outright declines, especially for older cabins with wood roofs or tight clearances. Some households manage to stay insured by upgrading materials and thinning trees, while others end up in expensive specialty markets. The scenery is the same; the sense of security is not, and people feel that gap.

North Carolina Coast, Beach Dreams, Tighter Underwriting

Along the North Carolina coast, beach cottages and tall vacation homes now share space with growing doubts about long-term coverage. After years of storms and rising water, some major carriers have scaled back wind coverage or stopped renewing certain barrier-island policies altogether. Many owners juggle separate wind, flood, and homeowners policies, each with its own exclusions and steep deductibles. State-backed wind pools catch those who cannot find private options, but those pools depend on their own fragile funding. Ocean views still sell quickly, even as the safety net beneath them grows more complicated, layered, and thin.

Hawaii And Maui, After The Lahaina Fire

In Hawaii, the 2023 Lahaina fire reshaped how insurers think about risk in the islands. One blaze tore through a town, destroyed thousands of structures, and raised questions about vegetation management, power lines, and evacuation routes in other communities that look similarly exposed. Companies now face huge claims and legal fights while reinsurers rethink how much Hawaiian risk they want to hold. Premiums, deductibles, and scrutiny of older buildings have all climbed. For many residents, rebuilding is about more than wood and concrete; it also means hoping their next policy stays in place long enough to matter.

Iowa And The Hail Belt, Risk In The Heartland

In Iowa and other hail belt states, the threat comes not from oceans but from the sky overhead. Repeated severe thunderstorms, derechos, and baseball-sized hail have turned roofs into recurring six-figure losses for insurers that once treated the region as low drama. Companies respond with higher wind and hail deductibles, actual cash value settlements on roofing, or pauses on writing new business in hard-hit counties. Homeowners who rarely thought about climate risk now track radar maps and renewal dates with the same attention they once gave crop reports. Interior states no longer feel insulated from insurance shocks.