We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

Sanctions rarely announce themselves with a siren. They show up as a declined card at a hotel desk, a flight website that will not process payment, or an ATM that simply refuses a U.S. bank. In a handful of places, American travelers learn quickly that financial rules are part of the border. Some destinations are comprehensively sanctioned, while others trigger blocks only when a merchant, bank, or region falls on a restricted list. The result is the same: plans tighten, and improvisation gets expensive.

Cuba

Cuba’s beaches and music can feel close, but the payment reality is far away, and many U.S.-issued cards simply do not work at the counter or the ATM. Even travelers on permitted categories often find that terminals cannot connect back to U.S. banks, so lodging deposits, taxi fares, museum tickets, tips, and mobile top-ups start depending on cash and whatever exchange options are operating that day, sometimes with long lines and changing rates. The island can still feel warm and vivid, yet the practical rhythm is strict: planning is shaped less by desire and more by what money can actually move, hour by hour.

Iran

Iran is where sanctions stop being headlines and start dictating the day, because foreign credit and debit cards generally do not function for visitors. Most travelers rely on cash and prearranged payments through intermediaries, which makes hotels, trains, and domestic flights possible but leaves little room for refunds, last-minute changes, or surprise expenses like medical supplies, extra nights, rerouted transport, or fees at check-in. A routine moment elsewhere, like paying for a late check-in, a backup SIM, or an emergency pharmacy run, can become the point where an itinerary stalls, simply because no card can bridge the gap.

North Korea

North Korea runs on a cash economy for visitors, and foreign debit and credit cards are not accepted in any normal, reliable way. With no dependable ATMs to repair a mistake, even small purchases become a budgeting exercise in physical bills, and most services are arranged and paid in advance through tightly controlled channels, leaving little space to extend a stay, change hotels, upgrade transport, or replace lost items. Even tipping, snacks, and souvenirs can require exact amounts, so the trip can feel carefully staged, and money becomes a hard boundary that limits choices long before any sightseeing begins.

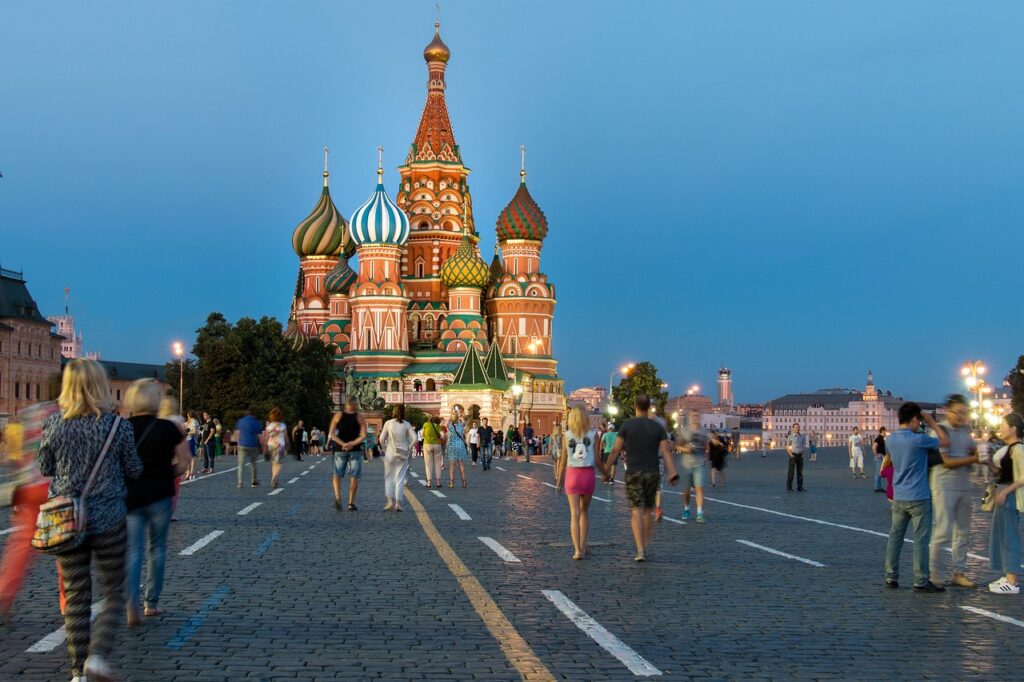

Russia

In Russia, the shock is not one declined charge but a system-level change, since major U.S. card networks suspended operations. Cards issued outside Russia typically stop working for everyday purchases, cash withdrawals, and many online bookings tied to Russian merchants, and some travel platforms and digital services also geoblock by location, merchant category, bank routing, or sanctioned counterparties. Travel becomes an exercise in legal preplanning and redundancy, because the old assumption that a card can solve a problem on the spot, from a hotel deposit to a missed-train rebooking or a medical copay, no longer holds.

Belarus

Belarus sits near major European corridors, yet sanctions can make it feel financially detached, especially when transactions intersect with sanctioned banks or state-linked entities. Some U.S. card products have been suspended, and charges may be declined, reversed, or flagged without warning, creating uneven results where a café purchase succeeds but a hotel desk, rail counter, event ticket booth, or fuel stop fails at the worst time. That unevenness is the real stressor, because it forces travelers to build buffers and backups, keep receipts, and confirm payment options in advance instead of relying on a single swipe.

Crimea

Crimea shows how regional sanctions can override national habits in a single swipe, because many payment systems treat the peninsula as a restricted location regardless of intent. Card networks have halted services there in response to U.S. rules, and global platforms often block payments, bookings, and app-based services when a transaction is tied to Crimea by merchant, IP location, billing address, or even a map pin. A trip can look simple on a map yet turn into lockout where deposits fail, rides disappear, customer support ends early, and refunds become slow or impossible to process, pushing everything back to cash and manual fixes.

Donetsk Region

The Donetsk region, in the areas covered by U.S. sanctions, is less a leisure destination than a compliance trap with broad restrictions on services and transactions. Reputable payment processors tend to block anything that appears connected to the region, including charges routed through local banks or merchants, and mainstream travel platforms may not provide normal protections like dispute handling, insurance coverage, or verified reservations. Even before safety is considered, the financial reality is stark: paying for basics can become a legal question, and the lack of reliable payment rails can strand people quickly.

Venezuela

Venezuela’s payment friction often shows up as everyday unpredictability: processors that work in one neighborhood may fail in another, and “normal” banking assumptions can break down without warning. When issuers flag risk or compliance concerns, declines can hit the worst categories first, like transport, fuel, lodging deposits, and higher-value purchases that look harder to verify. What feels like a simple errand elsewhere can turn into a chain of retries, cash hunting, and backup planning, especially outside major business districts where options thin out fast.