We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

Tourism along the U.S.–Mexico border has always reflected national politics, but recent elections and policy swings have made those effects more measurable than ever. Cities that once relied on cross-border shoppers, quick leisure visits, and cultural day-trips have seen noticeable shifts as new enforcement rules, wait-time fluctuations, and travel advisories reshape visitor behavior. While overall crossings still number in the millions each year, several border cities report changes ranging from lighter foot traffic in downtown districts to smaller hotel occupancy surges during peak seasons. These twelve cities reveal how evolving federal priorities can alter local tourism patterns, often in ways that don’t fit neatly into national narratives yet remain deeply felt in the daily life of border communities.

1. El Paso, Texas

Over the past election cycles, El Paso has experienced a measurable shift in tourism as policy changes influenced both perception and cross-border mobility. Local travel analysts noted that annual visitor counts, once hovering near 2.4 million, slipped closer to 2.1 million after stricter enforcement periods increased wait times and discouraged spontaneous trips. Hotel occupancy also fluctuated, dropping by roughly 7% during months of high political tension. Though the city maintains strong cultural appeal, its downtown retail corridor reports lower weekend traffic from Juárez shoppers, suggesting changing habits among short-trip visitors.

2. San Diego, California

San Diego’s border-adjacent tourism has long benefited from its proximity to Tijuana, but political shifts altered some traveler behavior, especially for day-trippers using the San Ysidro crossing. Visitor bureaus estimate that cross-border leisure visits, previously around 35,000 per day, fell closer to 29,000 during periods of heightened policy uncertainty. Local businesses near the port of entry reported revenue fluctuations between 5–9%, reflecting fewer spontaneous cross-border meals and shopping trips. While the broader city remains a major tourism hub, the micro-economy around the border has clearly become more sensitive to changes in national immigration direction.

3. Laredo, Texas

Photographer: Donna Burton

Laredo, historically sustained by a mix of shopping travelers and short-term international visitors, saw tourism dynamics shift as election-linked enforcement policies tightened. City tourism offices indicated that annual non-commercial visitor crossings, once topping 10 million, dipped closer to 8.7 million during stricter periods. Retail districts that depend heavily on Mexican consumers experienced revenue swings up to 12%, especially during holiday seasons. Although trade traffic remains strong, the discretionary visitor segment, crucial for local hospitality has grown more unpredictable as federal border narratives influence personal travel choices.

4. Nogales, Arizona

Nogales has felt a noticeable change in cross-border tourism as evolving political climates reshaped traveler confidence. Border patrol data suggests that pedestrian crossings, earlier averaging 6.5 million annually, slipped to roughly 5.8 million following years with more pronounced enforcement rhetoric. Local merchants, especially those near Morley Avenue, reported sales drops approaching 10% during tense political cycles. Even though essential crossings remain steady, the casual shopping and dental-tourism visitors who once filled weekend streets have become more cautious, illustrating how regional tourism can shift even without major infrastructure changes.

5. McAllen, Texas

McAllen’s tourism patterns shifted subtly but measurably as election periods heightened scrutiny around border mobility. Previously, the city attracted nearly 1.9 million short-stay visitors annually; recent years saw that figure fluctuate closer to 1.6–1.7 million depending on the political climate. Retail centers near the Hidalgo Bridge reported declines of 6–8% in cross-border shopper spending during periods of intense policy debate. While McAllen continues to host large conventions and medical tourists, the spontaneous leisure travel that once flowed freely from Reynosa has become more sensitive to shifting federal priorities.

6. Brownsville, Texas

In Brownsville, tourism related to day-trips and cross-border leisure has displayed marked variations after political transitions. Visitor tallies that once reached 1.4 million annually slipped closer to 1.2 million during heightened security seasons. Restaurants in the downtown district noted revenue dips of 5–7%, particularly on weekends once dominated by Matamoros shoppers. Hotel stays showed smaller impacts about 3% but enough for local officials to attribute the change to shifting border messaging and increased hesitation among travelers uncertain about wait times and inspection intensity at the international bridges.

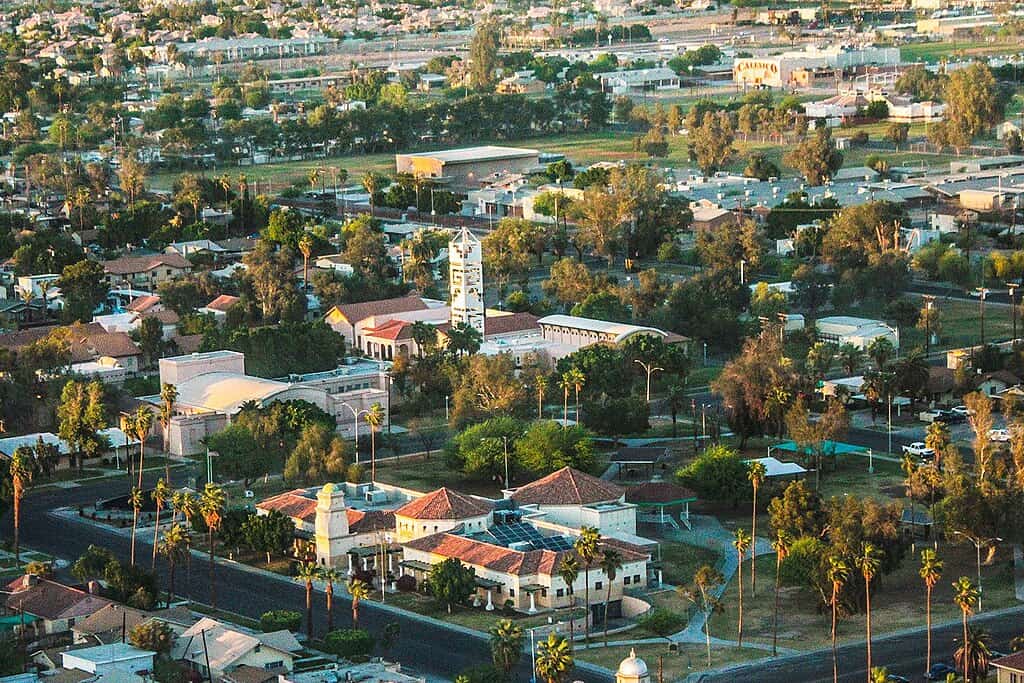

7. Calexico, California

Calexico’s tourism pulse has long depended on visitors from Mexicali, but federal political shifts have made that stream less predictable. Pedestrian crossings once averaging 4.3 million per year dropped to 3.9 million during stronger enforcement phases. Local shops, heavily reliant on cross-border consumer traffic, recorded losses up to 11% during policy-heavy election months. Even modest increases in inspection time, sometimes rising by 15–20 minutes, discouraged same-day shopping trips, underscoring how micro-level travel decisions in border towns closely track national immigration conversations.

8. Douglas, Arizona

Tourism in Douglas has shifted as changes in federal priorities affected travelers coming from Agua Prieta. Annual visitor estimates that had hovered around 600,000 dipped closer to 520,000 as stricter rules and media coverage influenced cross-border confidence. Local restaurants and boutiques saw sales variability near 8%, especially during periods when border-wait predictions extended beyond 40 minutes. Although Douglas maintains steady essential travel, the discretionary segment, visitors exploring its historic district or making routine shopping trips has grown more sensitive to national election-driven policy waves.

9. Del Rio, Texas

Del Rio experienced fluctuating tourism patterns as travelers from Ciudad Acuña adjusted to evolving border conditions. Visitor counts, previously at roughly 750,000 per year, shifted toward 660,000 during high-enforcement cycles. Local retailers reported revenue changes of 6–10%, particularly during seasons when federal policies dominated news coverage. Even slight increases in processing times rising by 10–15%, discouraged casual cross-border trips. Though outdoor recreation in the area remains strong, the city’s binational weekend tourism has clearly become more volatile.

10. Eagle Pass, Texas

Eagle Pass has faced tourism changes tied closely to national policy swings and intensified enforcement. Once receiving around 900,000 leisure and short-trip visitors annually, recent estimates place the number closer to 780,000 in politically charged years. Businesses near the international bridge observed sales declines of up to 9%, while hotels saw occupancy shifts of 4–5% during peak election seasons. The city’s reliance on casino-adjacent traffic and cross-border shoppers means that even modest changes in perceived border accessibility strongly ripple through local tourism revenue.

11. Yuma, Arizona

Yuma’s border-linked tourism reflected noticeable changes as national elections reshaped enforcement posture. Previously, the region saw around 1.2 million cross-border leisure interactions annually; recent cycles reduced that figure closer to 1.05 million as travelers reconsidered timing and frequency of visits. Retailers in the historic downtown corridor cited revenue fluctuations near 7%, much of it tied to diminished day-trip traffic. Although agricultural and military activity keep the economy strong, the softer border-tourism segment has grown increasingly susceptible to federal policy shifts.

12. San Luis, Arizona

San Luis, a smaller but active border community, recorded tourism variations as political changes affected visitor sentiment. Annual crossings tied to shopping and leisure, once near 3.1 million, hovered closer to 2.7 million in more restrictive periods. Local markets and cafés experienced sales impacts between 8–10%, especially during weekends that previously saw consistent flows from San Luis Río Colorado. Even though essential mobility remains high, discretionary tourism vital for main-street businesses, now fluctuates more sharply as voters shape new border agendas.