We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

Short-term rentals once grew faster than cities could regulate them, turning apartments into tourist lodgings and shifting entire housing markets. But from New York to Barcelona and Palm Springs, the era of effortless Airbnb hosting is closing. With rising rents, overtourism, and neighborhood strain, city governments are rewriting their rules, capping nights, revoking licenses, and tightening enforcement. The following twelve cities represent some of the strongest global moves reshaping how both locals and travelers experience urban life.

1. New York City, USA

New York’s Local Law 18, fully enforced since late 2023, reshaped the entire STR landscape by requiring full registration and host presence for stays under 30 days. With more than 40,000 unregistered listings removed in the first months, the city saw one of the sharpest declines in STR availability globally. Officials argue the changes protect housing stock in a city where rents climbed past $3,500 on average. For travelers, the rule essentially eliminates whole-unit rentals, shifting demand back to hotels and licensed stays.

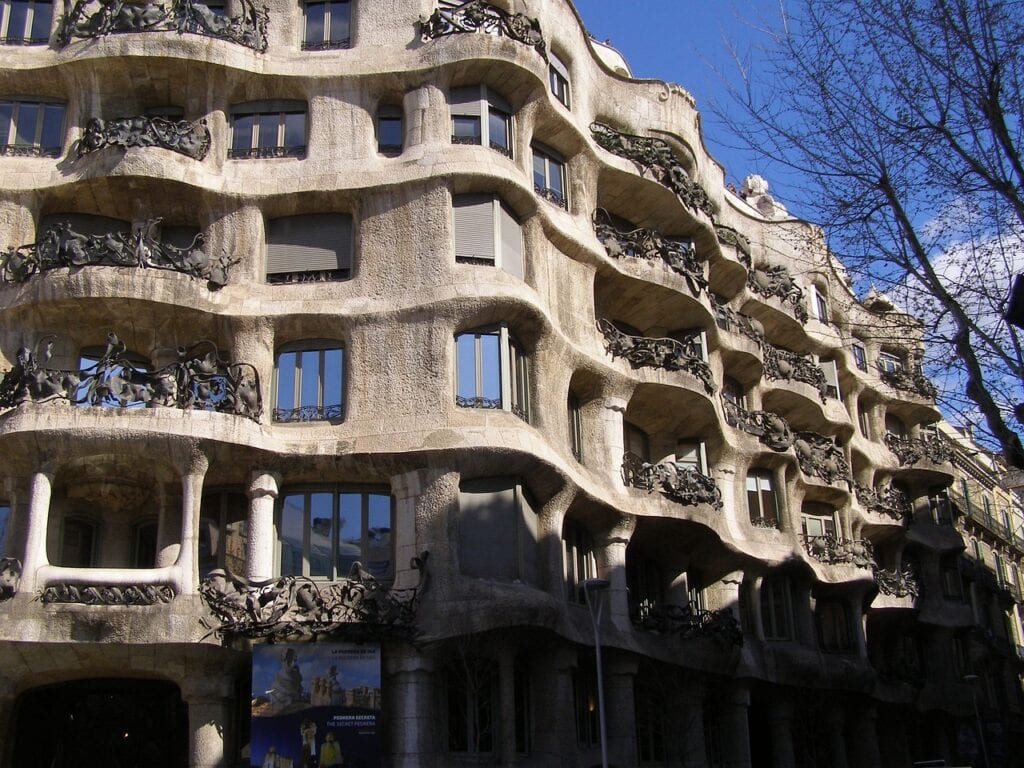

2. Barcelona, Spain

Barcelona is phasing out all short-term rental licenses by 2028, impacting roughly 10,000 tourist apartments that once fueled its booming visitor economy. The city cites rising rents up more than 20% in some districts and overcrowding in neighborhoods like Gothic Quarter and Barceloneta. By gradually removing permits rather than sudden bans, officials aim to stabilize local housing without shocking property owners. Still, travelers should expect diminishing STR choices as enforcement tightens each year.

3. Amsterdam, Netherlands

Amsterdam enforces one of Europe’s strictest STR systems, limiting many properties to 30 rental nights per year and requiring detailed registration for every listing. Some central districts ban entire-home rentals altogether, reflecting local frustration as tourism grew to nearly 20 million visitors annually. Fines for illegal rentals can reach €20,750, pushing investors to rethink the STR model. While residents welcome quieter streets and more housing supply, visitors must plan earlier to secure limited legal accommodations.

4. Vienna, Austria

Vienna expanded its STR rules in 2024, capping many properties at 90 rental days per year unless owners obtain special exemptions. With more than 1.9 million residents and rising demand for long-term units, the city sees STR restrictions as a tool to keep housing accessible. In several historic districts, additional limits prevent conversions of apartments into full-time tourist stays. The reforms aim for balance preserving tourism revenue while preventing STR saturation that once dominated certain neighborhoods.

5. Florence, Italy

Florence, struggling with heritage preservation and overtourism, banned new STR licenses in its UNESCO-protected historic center. More than 8,000 tourist apartments previously operated in zones where local housing availability sharply declined. Officials argue that unchecked STR growth turned residential streets into de facto hotel corridors. With tourism returning to pre-pandemic levels of over 16 million annual visitors, the city hopes the freeze restores stability for long-term tenants while still welcoming travelers through regulated stays.

6. Paris, France

Paris limits STRs to 90–120 nights per year, depending on property status, and now imposes fines up to €100,000 for illegal commercial-style operations. With nearly 95,000 listings at its peak, the city struggled to contain unregistered rentals in central arrondissements. Authorities intensified enforcement ahead of major events and ongoing housing pressures, as rents climbed past €1,500 for small units. These measures push property owners back toward long-term leasing, reducing STR saturation in dense neighborhoods.

7. Lisbon, Portugal

Lisbon halted new short-term rental “AL” licenses across 19 neighborhoods and 8 parishes, particularly in Alfama, Baixa, and Bairro Alto, where STR density exceeded sustainable thresholds. The city counted more than 23,000 AL units before the freeze, far outpacing housing supply for locals. Officials say limiting STR growth helps slow rent increases that climbed over 30% in just a few years. Visitors will still find licensed rentals, but expansion of new tourist flats is now heavily restricted.

8. Málaga, Spain

Starting in 2025, Málaga enacted a three-year freeze on new tourist-rental permits in 43 neighborhoods, most where STRs surpass 8% of the local housing stock. With over 12,600 holiday apartments offering more than 65,000 beds, the city saw sharp increases in prices and resident displacement. The freeze aims to rebalance coastal housing markets heavily shaped by tourism. While existing rentals can continue, investors face tighter scrutiny and fewer opportunities to enter the STR market.

9. Santa Monica, USA

Santa Monica enforces one of the strongest STR restrictions in the U.S., banning whole-unit rentals under 30 days and allowing only home-sharing where the host lives onsite. Operators must register, hold a business license, and pay a 14% occupancy tax, reducing illegal listings by thousands since enforcement began. With only a few hundred compliant hosts remaining, the city protects scarce housing in its 90,000-resident community. Travelers generally rely on hotels rather than standalone STRs.

10. Berlin, Germany

Berlin’s rental pressures pushed the city to tighten STR permits, especially for entire-home rentals operated by absentee owners. Many districts now require dedicated authorization that is increasingly difficult for investors to obtain. With rents rising more than 15% in key boroughs and STR clusters forming in areas like Mitte and Neukölln, the reforms target commercial-scale operators. As a result, hundreds of unauthorized listings have disappeared, steering more units back to long-term residents.

11. Palm Springs, USA

Palm Springs caps STRs at 20% of homes per neighborhood, creating waiting lists in saturated areas and reducing investor opportunities. The city tracks more than 3,000 active permits, but many owners face stricter noise rules, guest limits, and penalties for violations. Home values in STR-restricted zones reportedly dipped as speculative buying slowed. Officials argue that with tourism topping 14 million visitors regionally, rules are needed to protect residential streets from becoming permanent party zones.

12. Washington City, Utah, USA

Though smaller than major metros, Washington City introduced impactful rules requiring business licensing, safety checks, and a local 24/7 contact for every STR. Violations can bring fines up to $750 per day, prompting many casual hosts to reconsider renting. With population growth above 20% in recent years and rising visitor numbers from nearby parks, officials aim to prevent early STR saturation. The city’s approach shows that even mid-sized communities are tightening regulations before problems escalate.