We may earn money or products from the companies mentioned in this post. This means if you click on the link and purchase the item, I will receive a small commission at no extra cost to you ... you're just helping re-supply our family's travel fund.

Traveling to China in 2026 offers U.S. visitors a payment experience unlike anything back home. With digital wallets dominating more than 95% of urban transactions, cash is fading, and traditional cards no longer hold the same sway. Yet, despite modernization, there are quirks, limits, and unexpected surprises that can trip up even seasoned travelers. From QR codes to the emerging digital yuan, understanding how payments work now can save stress, time, and frustration while exploring one of the world’s most technologically advanced economies.

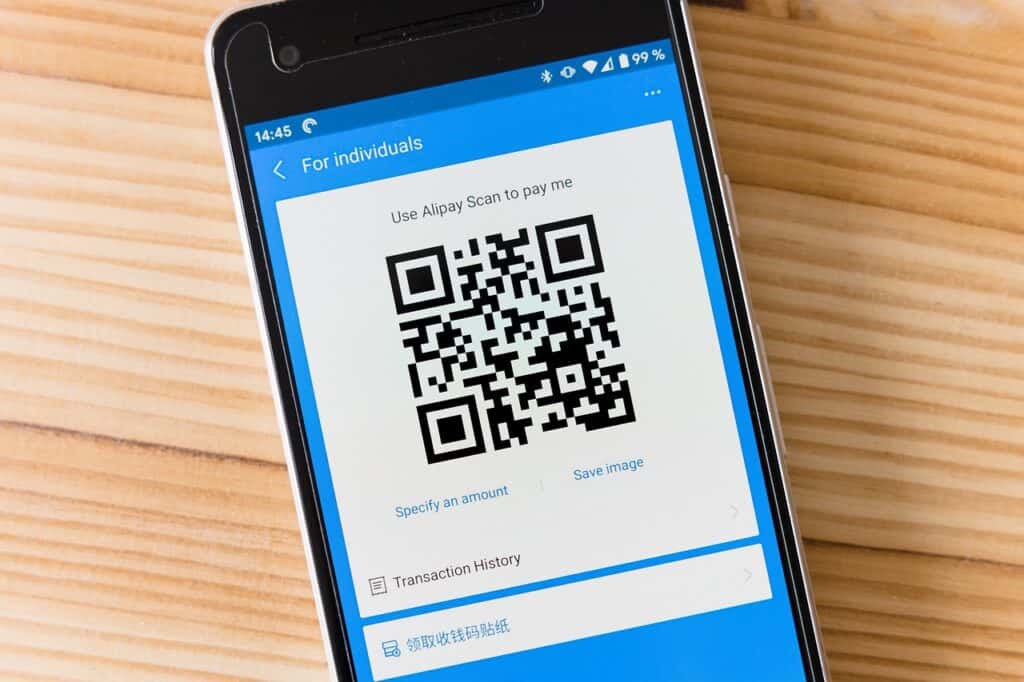

1. QR-Code Payments Are Nearly Everywhere

By 2026, QR-based payments dominate Chinese daily life, with over 92% of city transactions using mobile apps like Alipay or WeChat Pay. Even street vendors, small neighborhood shops, and taxis now rely primarily on digital wallets, often refusing cash entirely. A simple 25 RMB snack or 60 RMB taxi ride usually requires scanning a phone. Travelers quickly realize that relying on cash alone is insufficient. Although initially surprising, this system becomes remarkably convenient once familiar, making spontaneous purchases fast and seamless for anyone prepared.

2. Foreign Cards Can Link Directly to Chinese Apps

For the first time, most travelers can link Visa, Mastercard, or American Express cards directly to Alipay and WeChat Pay without a Chinese bank account. Identity verification typically takes under 10 minutes, after which purchases are charged straight to your card in RMB. Reports indicate over 85% of transactions succeed at major stores, restaurants, and tourist attractions. Setting this up before arrival saves frustration, especially for first-day hotel payments or airport taxis, ensuring visitors can fully enjoy China’s cashless convenience without unnecessary delays.

3. Not All Merchants Accept Foreign-Linked Cards

Even when a foreign card is linked, acceptance is inconsistent. Some small vendors prefer locally funded wallets due to slightly higher processing fees, around 1–3%. Travelers occasionally encounter refusals at family-run restaurants or local taxis. Having at least two apps plus a backup card mitigates these issues. Understanding this limitation prevents panic in moments where you cannot complete a routine purchase, such as a 60 RMB taxi ride. Planning redundancy is key, especially in rural areas or less touristy neighborhoods where foreign card usage is still limited.

4. Payment Limits Are Higher but Still Exist

China has raised mobile payment limits for foreign visitors: single transactions can reach roughly 5,000 USD, with annual caps even higher. Verification steps and occasional security checks may temporarily block spending until confirmed. While most travelers never hit these ceilings, knowing the limits helps avoid surprises when paying hotel bills or larger purchases, such as electronics. China prioritizes fraud prevention, so brief delays are normal. Awareness ensures smoother financial planning and prevents confusion when high-value transactions temporarily pause for verification.

5. Some Payments Don’t Require Chinese Apps

In select tourist hubs, foreign wallets and international banking apps can scan Chinese merchant QR codes directly, bypassing the need for Alipay or WeChat Pay. This service increasingly covers hotels, airports, and large restaurants, making it practical for short visits. Travelers staying less than a week benefit most, avoiding the hassle of registering a local account. It’s a helpful adaptation for newcomers, combining convenience with flexibility, and shows how China is gradually accommodating foreign payment methods while maintaining its overall cashless ecosystem.

6. Cash Still Serves as an Important Backup

Despite digital dominance, carrying 300–600 RMB remains wise. Rural areas, older neighborhoods, or temporary app outages make cash a valuable emergency tool. ATMs still function but are less common than a decade ago, and many foreign cards work reliably at major banks. Travelers report at least one instance where cash solved a problem instantly, proving that a small safety net can prevent major disruptions. Think of it as travel insurance in your pocket—rarely used, but invaluable in urgent situations.

7. Wallet Balances Work Differently for Foreigners

Even with linked cards, visitors usually cannot top up a stored wallet balance like locals do, since this requires a Chinese bank account. Payments instead draw directly from the connected card. This can confuse travelers expecting to preload 500–1,000 RMB for budgeting. Understanding this difference avoids frustration and simplifies tracking spending, whether paying for a 20 RMB coffee or a 30 RMB subway ride. Once grasped, the system is transparent, convenient, and aligns payments directly with foreign accounts.

8. Language Support Has Improved Significantly

In 2026, major apps offer full English interfaces, bilingual QR code instructions, and responsive customer support. Airports, hotels, and stores increasingly provide guidance in English, reducing errors and confusion. This improvement is crucial for the nearly 30 million foreign visitors China expects annually, making payments easier and less stressful. Travelers now navigate verification steps confidently, enjoy smooth transactions, and experience the cashless system without language barriers, which was a significant challenge just a few years ago.

9. Technical Glitches Still Occur

Even with robust infrastructure, temporary freezes, declines, or verification delays sometimes happen. Busy periods, such as Golden Week or major holidays, stress the system with millions of transactions. Although most payments succeed smoothly, travelers occasionally experience brief inconveniences at metro gates or checkout counters. Redundancy using two apps, two cards, and carrying a bit of cash helps mitigate risk. Being aware that glitches are possible keeps expectations realistic, turning minor disruptions into manageable, brief hiccups rather than travel stress.

10. Digital Yuan (e-CNY) Remains Rarely Used by Tourists

While the central bank’s digital yuan exists and is expanding in pilot zones, most short-term visitors rely on Alipay and WeChat Pay. Usage among tourists remains under 15%, mainly in selected hotels, transport systems, or certain cities. It is interesting to observe but rarely essential. For practical purposes, foreign travelers should focus on mobile wallets, knowing the e-CNY may gain importance in future trips. Being aware of it, however, provides context for China’s evolving digital currency landscape, blending curiosity with practical preparation.